Installing Solar Across Illinois

We are extremely proud of our Illinois roots, where we have a long-standing history of installing solar energy systems for commercial and utility-scale projects. With a reputation for quality installation, expertise, and five-star service, our team’s design and installation of solar energy systems started in the heart of the Midwest.

Solar in Illinois

Illinois has experienced significant growth in solar power installations, and we’re excited to be a renewable energy partner in the state. According to the Solar Energy Industries Association (SEIA), the state's solar capacity increased from just nine megawatts (MW) in 2015 to over 1,750 MW by the end of 2020.1 We’re proud to be a service provider in the first Midwest state to set a bold goal to reach 100% renewable energy by 2050.1 *

Renewable by 2050

Illinois’ roadmap sets a goal for the state to rely 100% on renewable energy by 2050.1

Services We Offer to Illinoisans

When you choose Nelnet Renewable Energy, you’re getting an entire team of experts to handle everything from design to development and beyond.

Ready for a free residential estimate?

Get Started TodayOur Illinois Solar Plans

Purchase

Go solar by purchasing your solar system outright and benefit from your self-generated electricity as soon as your system goes online.

Financing

Create a financing program that can be customized to fit your needs and monthly budget – with no prepayment penalties.

Lease Options

For government entities and businesses, there are short-term lease options that require $0 out of pocket and can help maximize long-term savings.

We Partner With Illinois Solar for All

If you’re a homeowner, nonprofit, or public entity interested in going solar – or a developer of community solar projects – we can work with you to apply through the Illinois Solar for All program. This program provides additional incentive benefits for low-income and/or environmental justice areas, as well as job training programs.

Learn More about We Partner With Illinois Solar for AllOpportunities for Illinoisans to Save With Solar*

-

Claim a Credit on Your Federal Income Tax

Business taxpayers may be able to claim a tax credit on their federal tax return of 30% or more for qualified expenses on a solar system they own. Consult your tax advisor to determine whether this credit is available to you and for what amount. -

Earn Credits for Excess Energy Your System Produces

Full retail rate net metering may provide customers with credits for the excess generated energy from their solar system. If your solar system produces more energy than you’re using, you may get credits applied to your monthly electricity bill at the discretion of your utility provider.2 Net metering can vary, depending on your utility provider. -

Save With Other State and Local Incentives

Illinois is a great place to be when it comes to going solar! Utilities and local municipalities may offer additional solar incentives that property owners can take advantage of to save even more. Depending on your situation, here are some of the incentives and programs you may qualify for:- Solar Renewable Energy Credits (SRECs)

- Illinois Solar for All (ILSFA) Program

*Consult your tax advisor to determine which credits and incentives apply to your situation.

Gallery of Completed Projects

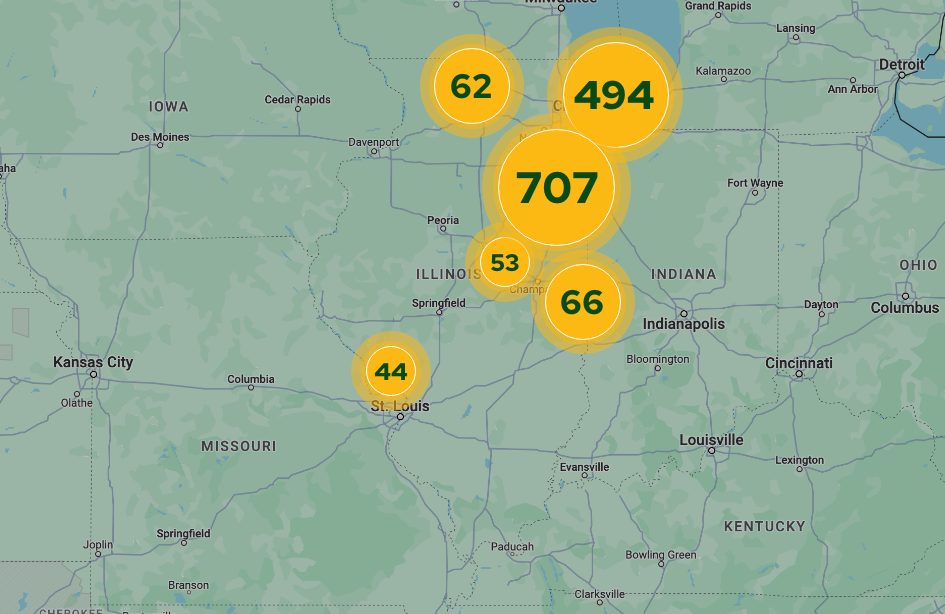

Installations Around Illinois

Our Illinois teams can provide a full range of solar services – from design to completion and beyond. Our expertise extends to the full installation and maintenance of commercial and agricultural solar systems

Illinois Offices

Nelnet Renewable Energy Headquarters: 204 Carpenter Ave., Wheeling, IL 60090

Hours: By Appointment | Phone: 312.859.3417 | Email: [email protected]

- 62 projects in the greater Rockford area

- 494 projects in the greater Palatine area

- 707 projects in the greater Naperville area

- 53 projects in the greater Bloomington area

- 66 projects in the greater Champaign area

- 44 projects in the St. Louis metro area

*Nelnet Renewable Energy is in no way affiliated with the state of Illinois.

The material on this website does not constitute and should not be relied on for tax, legal, investment, or accounting advice. You should consult your own tax, legal, and other professional advisors for such advice, with due consideration given to the risks of investing in renewable energy products and your own individual circumstances. The use of terms such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue”, “believe”, or other comparable terms are not guarantees of future performance and undue reliance should not be placed on them. Due to various risks and uncertainties, actual events or results may differ.